Calculate computer depreciation tax

Accumulated Depreciation Fixed Asset Cr. Car depreciation is an unavoidable part of vehicle ownership and the cost per mile to drive might actually be more than you think.

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

. The tax depreciation granted by the tax authorities on this asset are. For the next year you would start the depreciation calculation from the original cost minus the depreciation cost. Low and middle income earner tax offsets.

We welcome your comments about this publication and suggestions for future editions. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic. Businesses in the US will also have to calculate depreciation based on the US.

Below are the steps to sum of years digits method First calculate the depreciable amount which is equal to assets total cost of acquisition minus the salvage value Salvage Value Salvage value or scrap value is the estimated value of an asset after its useful life is over. Since 6000 of the 10000 of the seven-year property was placed in service in the fourth. Depreciation as per Income Tax Act 1961.

Taxpayers have to use the property to produce income to take the deduction on their taxes. The Entity Selection Calculator is designed for Tax Professionals to evaluate the type of legal entity a business should consider including the application of the Qualified Business Income QBI deduction. On 31st March 2022 he wants to calculate the depreciation amount for FY 2021-22.

MACRS allows you to take a larger tax deduction in the early years of an asset and less in later years. The annual depreciation expense for Ali would be 1000. Gain a proven solution for write-up AP AR payroll bank reconciliation asset depreciation and financial reporting.

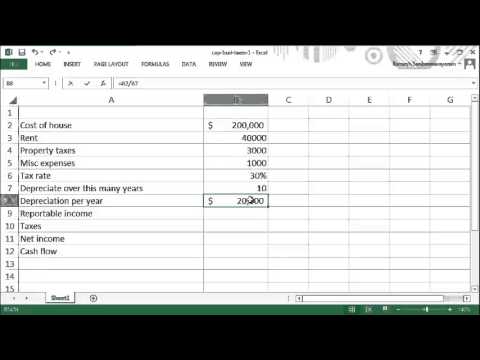

Use our free tax preparation fee calculator to help you make an informed decision. For tax depreciation different assets are sorted into different classes and each class has its own useful life. Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along.

Updated Study Notes and Revision Kits MASOMO MSINGI PUBLISHERS. Calculate the annual depreciation Ali should book for 5 years. Gain a proven solution for write-up AP AR payroll bank reconciliation asset depreciation and financial reporting.

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply. And life for this formula is the life in periods of time and is listed in cell C4 in years 5. Suppose ABC Pvt Ltd purchased a Computer costing Rs 50000 on 1st April 2021.

If depreciation charged for the year as per companies act is Rs. The only complain i have that I was told this led light would last for a long time but its died twice and the Whirlpool refrigerator is only two years old IcetechCo W10515057 3021141 LED Light compatible for Whirlpool Refrigerators WPW10515057 AP6022533 PS11755866 1 YEAR WARRANTY This is shown on the service. Salvage is listed in cell C3 10000.

Step 1Transition effect of depreciation. Cost Scrap Value Useful Life 5050 505 1000. The cost is listed in cell C2 50000.

Offset for maintaining an invalid or invalid carer. Get all the power of QuickBooks in a one-time purchase accounting software installed on your office computer. NW IR-6526 Washington DC 20224.

Super related tax offsets. 250000 and depreciation charged as per IT act is Rs. Whirlpool Refrigerator Led Lights Flashing.

Medical expenses tax offset. If your business uses a different method of depreciation for your financial statements you can decide on the assets useful life based on how long you expect to use the asset in your business. The second chart the Percentage Table Guide asks for the convention month or quarter that you placed the Toyota in service.

View this sample Reflection paperReflection essay. These are then used to calculate a figure which can be included in the working. You can send us comments through IRSgovFormCommentsOr you can write to.

MACRS is the primary depreciation method used for tax purposes. If you are using your vehicle for business purposes and putting additional mileage on it you may find that the wear and tear on a car is greater than if it were reserved solely for personal use. For this example well say your federal tax rate is 24 and your state tax.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Therefore a total of 2000 of depreciation will be charged over the life of the asset. He plans to sell the scrap at the end of its useful life of 5 years for 50.

Note that the accumulated depreciation is an account created to monitor the total depreciation expense taken over time and is offset against the computer equipment known as a contra account as it is an asset with a negative balance. The formula to calculate annual depreciation through straight-line method is. If a company purchases a computer worth 1000 with a projected lifetime of 4 years and you want to depreciate it at a 20 reducing balance you would simply multiply 1000 by 20 which gives you a value of 200.

Depreciation limits on business vehicles. In this article we will be discussing how to calculate deferred tax asset and liability that arises due to depreciation. Seniors and pensioners tax offset.

The amount youll use to calculate depreciation value will be 255000. As depreciation is one of the main reasons for having difference in accounting profits and IT profit. Then youll need to know the federal and state tax brackets you fall into.

A restaurant owner can usually expect to pay out large sums of money to get new equipment to get a restaurant off the ground or to renovate its kitchen. In all situations the missing figure is. Lump sum payments in arrears tax offsets.

We need to define the cost salvage and life arguments for the SLN function. Tax Code which allows businesses to take advantage of accelerated depreciation as specified by the Modified. Calculate the amount of depreciation charged till FY 2013-14.

View this sample. Government allowances and payments and the beneficiary tax offset. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021.

éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë ÉºÊÄ8ÌiB2mÕóLù-8Ûàu ÎY ÅV1ZÔÅÀwØ _fe pwõOÆqfšŠEww Á_. Zone and overseas forces tax offsets. Restaurant equipment can be expensive to purchase.

So both the computer and printer will be depreciated using the HY convention. Section 179 deduction dollar limits. Computer-Based Exam CBE centres.

For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the. The tax system is set up to allow restaurant owners to calculate the depreciation for restaurant equipment that they purchase. The first chart the MACRS Depreciation Methods Table tells you your Toyota is a non-farm 3- 5- 7- and 10-year property and that you use the GDS 200 method to calculate how much tax to deduct.

How To Calculate Depreciation

What Is The Capital Cost Allowance In Canada

11 Tax Credits And Exemptions Every Business Owner Should Know About

/GettyImages-1086691530-82d69e3d619b47a3883b0c71164a3260.jpg)

Calculate Depreciation Methods And Interpretation

Different Methods Of Depreciation Calculation Sap Blogs

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Using Spreadsheets For Finance How To Calculate Depreciation

Depreciation Calculator Depreciation Of An Asset Car Property

Compute Cash Flow After Depreciation And Tax Youtube

Method To Get Straight Line Depreciation Formula Bench Accounting

How To Calculate Depreciation Expense For Business

Depreciation Rate Formula Examples How To Calculate

Manufacturing Equipment Depreciation Calculation Depreciation Guru

Depreciation Tax Shield Depreciation Tax Shield In Capital Budgeting

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic